THIS INDENTURE made at (name of City/Town/Village), this (date) day of (month) 19 (year), BETWEEN Mr./Mrs./Ms.______________________________ of (city/town/village), Indian inhabitant, residing at (address)____________________________________________ (hereinafter called “the settlor”) (which expression shall, unless repugnant to the context or meaning thereof, be deemed to include their respective heirs, executors and administrators) of the one part and Mr./Mrs./Ms._______________________________ of (city/town/village), Indian inhabitant, residing at ________________(address) ____________________________________ and Mr./Mrs. /Ms.____________________________________ of (city/town/village), Indian inhabitant, residing at (address)_____________________________________ (hereinafter called “the trustees”) (which expression shall, unless repugnant to the context or meaning thereof, be deemed to mean and include the survivor or survivors of them and the heirs, executors and administrators of the last survivor, their/his or her assigns and the trustee or trustees, for the time being, of the said trust) of the other part.

WHEREAS the settlors are desirous of creating a trust in respect of the sum of Rs. (in figures), [Rupees ________________(in words) only] in the manner hereinafter appearing.

AND WHEREAS the trustees have consented to act as the first trustees of these presents and to accept the trusts under these presents as testified by their being parties to and executing the same.

NOW THIS INDENTURE WITNESSETH AS FOLLOWS:

1) The trust created by these presents shall be known as “ (name of trust) ” (hereinafter called “the said trust”).

2) The trustees do declare that they, the trustees, shall hold and stand possessed of the sum of Rs. (in figures), [Rupees (in words) only]

(hereinafter, for brevity’s sake, referred to as “the trust fund” which expression shall, unless repugnant to the subject or context, also include any other property and investments of any kind whatsoever into which the same or any part thereof may be converted, invested or varied, from time to time, and those which may be acquired by the trustees or come to their hands by virtue of these presents or by operation of law or otherwise howsoever in relation to these presents, including all donations either in cash or other properties, movable or immovable, which may be received by the trustees, from time to time, from any person or persons for the purposes of these presents) upon the trusts and with and subject to the powers, provisions, agreements and declarations hereinafter appearing and contained of and concerning the same.

It shall be lawful for the trustees to augment the resources of the trust by raising funds in every lawful and permissible way, through public entertainment programmes like charity shows, concerts, carnivals, festivals, printing, publishing and selling books, magazines, greeting cards, calendars, diaries and undertaking income-generating activity which may be incidental, or ancillary to, the attainment of the objects of the trust.

It shall also be lawful for the trustees to accept voluntary donations from individual or institutional sources, either Indian or foreign, and whether in cash or in kind or by way of a legacy or bequest.

The trustees may also allow a donor or sponsor to erect a building or buildings on any land belonging to the said trust for the furtherance of any object of the trust. All donations may be accepted either with or without any special conditions, as may be agreed upon between the donor and the trustees, PROVIDED THAT such conditions are not inconsistent with the intents and purposes of these presents and PROVIDED FURTHER that the name of the said trust mentioned in clause 1 hereof shall not be altered. All donations, including those of lands, buildings and other immovable properties, shall be treated as forming part of the trust fund being the subject matter of these presents and be applied accordingly. The trustees shall also be at liberty to refuse any donation, legacy or gift, without giving any reason for such refusal.

3) The trustees shall hold and stand possessed of the trust fund upon the following trusts, viz.,:

a) to manage the trust fund and collect and recover the interest, dividends and income thereof and to pay thereout the expenses of collection and other outgoings, if any;

b) to pay or utilise the balance of such interest, dividends and income of the trust and, if the trustees so desire, the corpus or part of the corpus for all, or any one or more of, the following purposes to the intent that such income or corpus shall be applied to such purposes (and that such income shall be applied or accumulated for application to such charitable purposes) and to the further intent that all such purposes shall be carried out without reference to religion, caste, creed or colour and in such shares and proportions and in such manner in all respects as the trustees shall, in their absolute discretion, think fit, that is to say:

* to encourage, assist and support the cause of education, research, science, medicine, arts, culture, human resource development, removal of poverty and human suffering and the advancement of any other object of general public utility without distinction to caste, creed, colour, community, gender or religion. Without prejudice to the generality of the foregoing, the trustees at their absolute discretion, may carry out any one or more of the following purposes:

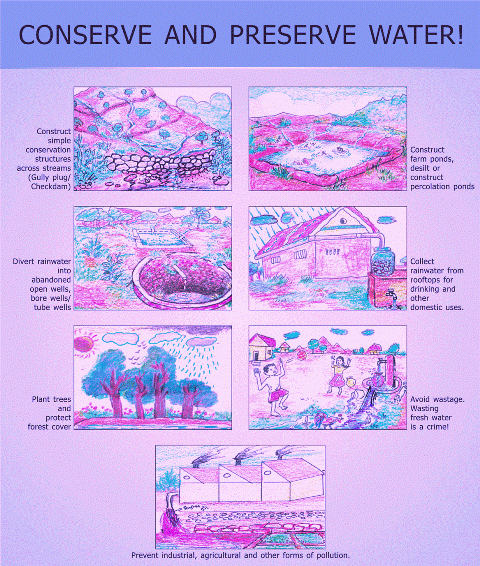

a) to undertake various programmes for conservation of natural resources as well as to carry out scientific research in the field of energy conservation and other allied fields;

b) to establish, fund and support new institutions for training or research or a chamber or federation of energy institutions;

c) to undertake, assist and finance any programme of conservation of natural resources in general and thermal and other forms of energy in particular;

d) to create nationwide awareness of energy conservation through presentation of Energy Conservation Awards, providing training through lectures, seminars and workshops and educational and professional institutions and associations, through funding of research scholarships, endowments and other forms of financial assistance for research scholars in the field;

e) to carry out, organise, sponsor, promote, establish and conduct scientific research activities of all kinds in general and in the field of conservation of natural resources in particular, including development and application of non-depleting and non-polluting sources of energy (such as solar, wind, tidal and ocean-thermal energy) as well as development and application of achieving fuller and less polluting utilisation of fossil and/or nuclear fuel;

f) to edit, print, publish or cause to edit, print, publish books, magazines, journals, periodicals, brochures and/or any other audio or audio-visual material for the advancement and dissemination of useful information on energy conservation or any other subject;

g) to promote, maintain or assist all activities by individuals or institutions anywhere in the Republic of India which are in conformity with the objects of the trust and are conducive to the wellbeing and general welfare of the society.

AND the trustees shall do all other acts and things necessary for or incidental or conducive to effectuating the foregoing purposes or which would further or fulfil the objectives mentioned herebefore. The trustees shall have powers, by due process of law, to add any other object or objects of general public utility to the objects hereinbefore set out, provided the majority of the trustees agree to the same and the objectives added are of a charitable nature only.

4) It is expressly provided that if any one or more of the objects hereinbefore specified, or hereafter added, are held not to be objects of a public charitable nature, the trustees shall not carry out such object or objects, but the validity of the said trust as a trust, for public charitable purposes, shall not be affected in any manner.

5) It shall be lawful for the trustees to provide aid by way of donations out of the income or the corpus of the trust fund (to any extent they deem fit), or otherwise to different philanthropic institutions, societies, organisations, trusts or other agencies which may have been established for charitable purposes mentioned in clause 3) of these presents, to enable such institutions, societies, organisations, trusts or agencies to start, maintain or carry out such charitable objects.

6) a) Any trustee may, at any time, retire or resign from the office of trustee.

b) The trustees, for the time being (or in the event of there being, at any time, only one remaining trustee, then the said sole remaining trustee) may, at any time, appoint any other person or persons as trustee or trustees of the said trust, after receiving the written consent of the person or persons to be appointed as a trustee or trustees and passing a formal resolution, either at a duly convened meeting of the trust or by circular.

AND UPON every such appointment, the trust fund hereby settled and the investments for the time being representing the same shall be so transferred as to become vested in the trustee or trustees so appointed, and every trustee so appointed may as well before as after such transfer act as fully and effectually as if he had been originally appointed a trustee, PROVIDED ALWAYS that without prejudice to any other provisions of the law, any trustee of these presents shall stand discharged from the office of trustee on his/her tendering resignation of his/her office and on the same being accepted by the remaining trustee/s of these presents.

All the founder-trustees, and the trustees appointed subsequently, may remain trustees for life unless they voluntarily resign, die or are removed for reasons of continuous neglect of duty, misconduct or breach of trust, under the provisions of the Bombay Public Trusts Act.

The total number of trustees shall not be less than 3 (three) and not more than 9 (nine).

7) The trustees shall appoint one of them to act as the chairman of the board of trustees. The chairman shall preside at all meetings. In the absence of the chairman at any meeting, the majority of trustees who may be present at the meeting, shall elect a chairman for the meeting. The trustees shall frame and regulate their own procedure relating to the meeting of the board of trustees. The trustees shall be entitled to set up a committee or committees for the purpose of effective management, resource mobilisation, finance, projects and any other broad or specific purpose or purposes for fulfilling the aims and objectives of the trust. It shall be lawful for the trustees to appoint directors, executives and officers, on such terms and conditions as may be agreed upon.

The trustees, at their absolute discretion, may also frame from time to time a scheme or schemes for membership to provide members of the scientific/research community or members of the general public to feel a sense of involvement with the trust and participate more actively and effectively in furthering the objects of the trust. The powers and duties of such members shall be regulated by the trustees from time to time and the trustees shall reserve the right to remove any erring member or terminate the membership scheme if and when found necessary and in the best interests of the trust.

All the trustees of the trust will be jointly and severally responsible. However, the day-to-day management of the trust may be handled by the chairman or a duly appointed managing trustee, with the help of paid employees.

8) The trustees shall be entitled, from time to time, to open, operate and maintain a banking account or accounts in the name of the said trust, at such scheduled bank or banks as they may, from time to time, decide and may at any time pay, or cause to be paid, or withdraw any moneys forming part of the trust fund or the income thereof to the credit of any such account or accounts and either by way of fixed deposit or current account or any other account. The banking account or acounts may be operated jointly by any two or more authorised trustees of the trust.

9) Any investment or investments in which the trustees may be authorised by law for the investment of the trust property in India, may be made payable or transferable by any two or more of the trustees.

10) It shall be lawful for the trustees to acquire by purchase or on lease or on ownership basis or otherwise, lands, buildings and movable and immovable properties comprised in the trust fund, in any manner they think fit and to expend for all, or any of the above purposes, such moneys out of the trust fund or the income thereof as the trustees may, in their absolute discretion, think fit and proper.

11) With the sanction of the charity commissioner, it shall be lawful for the trustees at such time or times, as they may in their absolute discretion think fit, to sell or acquire by public auction or private contract or exchange or transfer or assign or grant leases or sub-leases for any term, however long, or otherwise dispose of or surrender all or any part of the trust fund including the immovable properties comprised therein and on such terms and conditions relating to title or otherwise and in all respects as they may think proper and to buy and rescind or vary any contract for sale, exchange, transfer, assignment, lease, sub-lease, or other disposition or surrender or release and for such purposes to execute all necessary conveyances, deeds of exchange, assignments, transfers, leases, sub-leases, surrenders, releases, counterparts and other assurances, instruments and writings and to pass, give and execute necessary receipts, releases and discharges for the consideration moneys or otherwise relating to the documents and assurances. All moneys arising from any such transfer or other assurances shall be deemed to be part of the trust fund and shall be applicable accordingly.

12) Upon any sale or other transfer by the trustees, under the power aforesaid, any purchaser or transferee dealing bonafide with the trustees shall not be concerned to see or inquire whether the occasion for executing or exercising such power has arisen or whether the provisions as to the appointment and retirement of trustees herein contained, have been properly and regularly observed and performed. Neither shall the purchaser or transferee be concerned to see to the application of the purchase moneys or other consideration or be answerable for the loss, misapplication or non-application thereof.

13) It shall be lawful for the trustees, from time to time, at their discretion and, if necessary, with the prior permission of the charity commissioner, to borrow or raise or secure the payment of any sum or sums of money and to mortgage or charge all or any part of the trust fund.

14) The receipt of any two trustees, as authorised by the board of trustees, for any income of the trust fund or for any documents of title or securities, papers or other documents or for any other moneys or property forming part of the trust fund, shall be sufficient and shall effectually discharge the person or persons paying or giving or transferring the same from being bound to see to the application or being answerable for the loss, misapplication or non-application thereof.

15) The trustees shall have the power at their discretion, instead of acting personally, to employ and pay any agents (including banks) to transact any business or do any act whatsoever in relation to the said trust, including receipt and payment of money, without being liable for loss and shall be entitled to be allowed and paid all charges incurred thereby.

16) It shall be lawful for the trustees to settle all account and to compromise, compound, abandon, withdraw or refer to arbitration any actions, proceedings or disputes, claims, demands or things relating to any matter in connection with the said trust and to do all other things proper for such purpose, without being responsible for any loss occasioned thereby.

17) The trustees shall be respectively chargeable for such trust funds and income including money, stocks, funds, shares and securities as they shall actually receive, notwithstanding their respectively signing any receipts for the sake of conformity and shall be answerable and accountable only for their own acts, receipts, neglects or defaults and not for those of the other or others of them nor for any banker, broker, auctioner or agent or any other person with whom, or into whose hands, any trust fund or trust income may be deposited or come, nor for the insufficiency or deficiency of any stocks, funds, shares, or securities, nor for any other loss unless the same shall happen through their own wilful default or dishonesty respectively and, in particular, no trustee shall be bound to supervise or to check on any co-trustee or to take any steps or proceedings against a co-trustee for any breach, or alleged breach, of trust, committed by such co-trustee.

18) The trustees may reimburse themselves and pay and discharge out of the trust funds or moneys in their hands, all expenses incurred in or about the execution of the said trust. It is, however, expressly agreed and declared that the trustees shall be entitled to be paid their actual expenses for travel, boarding and lodging, or any other bonafide expense, which may be incurred by them in the performance of their duties as trustees. There shall be no remuneration payable to any trustee.

19) If any trustee, other than the settlor, shall be a lawyer, broker, accountant or person carrying on a profession, he or his firm shall be entitled to charge for his or their services, including all profits, costs and charges and including charges for work not strictly appertaining to a lawyer’s or accountant’s profession, in spite of the fact that he shall be a trustee of these presents, as if he had not been a trustee hereof.

20) The said trust shall be and remain irrevocable for all times, and the settlor doth hereby also release, relinquish, disclaim, surrender and determine all his/her rights, titles, interest or powers in the trust fund.

21) In all matters wherein the trustees have a discretionary power or wherein there shall be a difference of opinion regarding the construction of these presents of the management of the trust fund, or any part thereof, or the execution of any of the trusts or powers of these presents, or as regards any act or thing to be done by the trustees, the votes of the majority of the trustees, for the time being, voting in the matter shall prevail and be binding on the minority as well as on those trustees who may not have voted, and if the trustees shall be equally divided in opinion, the matter shall be decided according to the casting vote of the chairman.

22) Every power, authority or discretion conferred upon the trustees may be exercised or signified, either by some instrument in writing to be signed by a majority of the trustees or such of them as may be present in India, or by a resolution of the majority of the trustees or a majority of such of them as may be in the city and are present and voting at a meeting of the trustees. It shall be necessary to give at least ten days’ notice of any meeting of the trustees, and it shall be necessary to send an agenda and intimate the trustees of what is proposed to be decided at the meeting. Whereas the trustees shall endeavour to meet at least thrice a year and review the progress of the trust, the various sub-committees should meet as often as required, for the effective attainment of the goals and objectives of the trust.

23) If the majority of the trustees for the time being send any notice in writing to any trustee, other than the first trustees above-named, intimating that they think it is desirable in the interest of the trust that the trustee to whom the said notice is sent do cease to be a trustee, then from the date of the receipt of such notice by the said trustee, the said trustee shall be deemed to have resigned from his office as a trustee. Such notice shall be valid irrespective of the fact that there might be any disputes or differences between the trustees to whom the notice is sent, either relating to the affairs of the trust or otherwise. It shall be proper to state in, or with regard to, any such notice the reasons why the trustees giving the notice think it desirable in the interest of the trust, that the trustee to whom the said notice is given, do cease to be a trustee. It is also recommended in the interest of natural justice to give hearing, personal or otherwise, to the trustee to whom any such notice is, or is to be, given. Any such notice as aforesaid shall be deemed to have been received by the trustee to whom it has been sent, if it is duly sent to the said trustee by registered post at his last known place of residence or business.

24) The trustees shall keep, or cause to be kept, all statutory records, including all legal documents, registers, books of account, minute books and have the accounts audited annually by qualified chartered accountants. The financial year of the trust shall begin on 1st April and end on 31st March.

25) It shall be lawful for the trustees, from time to time, to frame such rules and regulations for the management and administration of the trust, as they shall think fit, and to alter or vary the same, from time to time, and to make new rules and regulations, provided that such rules and regulations shall not be inconsistent with the terms and intents of these presents.

26) The trustees may, with the permission of the charity commissioner or any other competent authority in law, make amendments in the trust deed by execution of such deeds or deed-polls, as may be expedient, so as to bring the provisions of the trust in consonance and conformity with the provisions of the law for the time being in force, from time to time, relating to public charitable trusts including compliance with any legitimate directions or requisitions of any authorities or officers which may be deemed expedient for carrying out the objectives of the trust, PROVIDED ALWAYS that no changes shall be made by the trustees which may result in the trust ceasing to be a public charitable trust.

IN WITNESS WHEREOF, the parties hereto have set and subscribed their respective hands and seals, the day and year first hereinabove written.

SIGNED, SEALED AND DELIVERED

by the withinnamed settlors

______________________________

______________________________

______________________________

______________________________

in the presence of

SIGNED, SEALED AND DELIVERED

by the withinnamed trustees

________________________________

________________________________

________________________________

________________________________

in the presence of

WHEREAS the settlors are desirous of creating a trust in respect of the sum of Rs. (in figures), [Rupees ________________(in words) only] in the manner hereinafter appearing.

AND WHEREAS the trustees have consented to act as the first trustees of these presents and to accept the trusts under these presents as testified by their being parties to and executing the same.

NOW THIS INDENTURE WITNESSETH AS FOLLOWS:

1) The trust created by these presents shall be known as “ (name of trust) ” (hereinafter called “the said trust”).

2) The trustees do declare that they, the trustees, shall hold and stand possessed of the sum of Rs. (in figures), [Rupees (in words) only]

(hereinafter, for brevity’s sake, referred to as “the trust fund” which expression shall, unless repugnant to the subject or context, also include any other property and investments of any kind whatsoever into which the same or any part thereof may be converted, invested or varied, from time to time, and those which may be acquired by the trustees or come to their hands by virtue of these presents or by operation of law or otherwise howsoever in relation to these presents, including all donations either in cash or other properties, movable or immovable, which may be received by the trustees, from time to time, from any person or persons for the purposes of these presents) upon the trusts and with and subject to the powers, provisions, agreements and declarations hereinafter appearing and contained of and concerning the same.

It shall be lawful for the trustees to augment the resources of the trust by raising funds in every lawful and permissible way, through public entertainment programmes like charity shows, concerts, carnivals, festivals, printing, publishing and selling books, magazines, greeting cards, calendars, diaries and undertaking income-generating activity which may be incidental, or ancillary to, the attainment of the objects of the trust.

It shall also be lawful for the trustees to accept voluntary donations from individual or institutional sources, either Indian or foreign, and whether in cash or in kind or by way of a legacy or bequest.

The trustees may also allow a donor or sponsor to erect a building or buildings on any land belonging to the said trust for the furtherance of any object of the trust. All donations may be accepted either with or without any special conditions, as may be agreed upon between the donor and the trustees, PROVIDED THAT such conditions are not inconsistent with the intents and purposes of these presents and PROVIDED FURTHER that the name of the said trust mentioned in clause 1 hereof shall not be altered. All donations, including those of lands, buildings and other immovable properties, shall be treated as forming part of the trust fund being the subject matter of these presents and be applied accordingly. The trustees shall also be at liberty to refuse any donation, legacy or gift, without giving any reason for such refusal.

3) The trustees shall hold and stand possessed of the trust fund upon the following trusts, viz.,:

a) to manage the trust fund and collect and recover the interest, dividends and income thereof and to pay thereout the expenses of collection and other outgoings, if any;

b) to pay or utilise the balance of such interest, dividends and income of the trust and, if the trustees so desire, the corpus or part of the corpus for all, or any one or more of, the following purposes to the intent that such income or corpus shall be applied to such purposes (and that such income shall be applied or accumulated for application to such charitable purposes) and to the further intent that all such purposes shall be carried out without reference to religion, caste, creed or colour and in such shares and proportions and in such manner in all respects as the trustees shall, in their absolute discretion, think fit, that is to say:

* to encourage, assist and support the cause of education, research, science, medicine, arts, culture, human resource development, removal of poverty and human suffering and the advancement of any other object of general public utility without distinction to caste, creed, colour, community, gender or religion. Without prejudice to the generality of the foregoing, the trustees at their absolute discretion, may carry out any one or more of the following purposes:

a) to undertake various programmes for conservation of natural resources as well as to carry out scientific research in the field of energy conservation and other allied fields;

b) to establish, fund and support new institutions for training or research or a chamber or federation of energy institutions;

c) to undertake, assist and finance any programme of conservation of natural resources in general and thermal and other forms of energy in particular;

d) to create nationwide awareness of energy conservation through presentation of Energy Conservation Awards, providing training through lectures, seminars and workshops and educational and professional institutions and associations, through funding of research scholarships, endowments and other forms of financial assistance for research scholars in the field;

e) to carry out, organise, sponsor, promote, establish and conduct scientific research activities of all kinds in general and in the field of conservation of natural resources in particular, including development and application of non-depleting and non-polluting sources of energy (such as solar, wind, tidal and ocean-thermal energy) as well as development and application of achieving fuller and less polluting utilisation of fossil and/or nuclear fuel;

f) to edit, print, publish or cause to edit, print, publish books, magazines, journals, periodicals, brochures and/or any other audio or audio-visual material for the advancement and dissemination of useful information on energy conservation or any other subject;

g) to promote, maintain or assist all activities by individuals or institutions anywhere in the Republic of India which are in conformity with the objects of the trust and are conducive to the wellbeing and general welfare of the society.

AND the trustees shall do all other acts and things necessary for or incidental or conducive to effectuating the foregoing purposes or which would further or fulfil the objectives mentioned herebefore. The trustees shall have powers, by due process of law, to add any other object or objects of general public utility to the objects hereinbefore set out, provided the majority of the trustees agree to the same and the objectives added are of a charitable nature only.

4) It is expressly provided that if any one or more of the objects hereinbefore specified, or hereafter added, are held not to be objects of a public charitable nature, the trustees shall not carry out such object or objects, but the validity of the said trust as a trust, for public charitable purposes, shall not be affected in any manner.

5) It shall be lawful for the trustees to provide aid by way of donations out of the income or the corpus of the trust fund (to any extent they deem fit), or otherwise to different philanthropic institutions, societies, organisations, trusts or other agencies which may have been established for charitable purposes mentioned in clause 3) of these presents, to enable such institutions, societies, organisations, trusts or agencies to start, maintain or carry out such charitable objects.

6) a) Any trustee may, at any time, retire or resign from the office of trustee.

b) The trustees, for the time being (or in the event of there being, at any time, only one remaining trustee, then the said sole remaining trustee) may, at any time, appoint any other person or persons as trustee or trustees of the said trust, after receiving the written consent of the person or persons to be appointed as a trustee or trustees and passing a formal resolution, either at a duly convened meeting of the trust or by circular.

AND UPON every such appointment, the trust fund hereby settled and the investments for the time being representing the same shall be so transferred as to become vested in the trustee or trustees so appointed, and every trustee so appointed may as well before as after such transfer act as fully and effectually as if he had been originally appointed a trustee, PROVIDED ALWAYS that without prejudice to any other provisions of the law, any trustee of these presents shall stand discharged from the office of trustee on his/her tendering resignation of his/her office and on the same being accepted by the remaining trustee/s of these presents.

All the founder-trustees, and the trustees appointed subsequently, may remain trustees for life unless they voluntarily resign, die or are removed for reasons of continuous neglect of duty, misconduct or breach of trust, under the provisions of the Bombay Public Trusts Act.

The total number of trustees shall not be less than 3 (three) and not more than 9 (nine).

7) The trustees shall appoint one of them to act as the chairman of the board of trustees. The chairman shall preside at all meetings. In the absence of the chairman at any meeting, the majority of trustees who may be present at the meeting, shall elect a chairman for the meeting. The trustees shall frame and regulate their own procedure relating to the meeting of the board of trustees. The trustees shall be entitled to set up a committee or committees for the purpose of effective management, resource mobilisation, finance, projects and any other broad or specific purpose or purposes for fulfilling the aims and objectives of the trust. It shall be lawful for the trustees to appoint directors, executives and officers, on such terms and conditions as may be agreed upon.

The trustees, at their absolute discretion, may also frame from time to time a scheme or schemes for membership to provide members of the scientific/research community or members of the general public to feel a sense of involvement with the trust and participate more actively and effectively in furthering the objects of the trust. The powers and duties of such members shall be regulated by the trustees from time to time and the trustees shall reserve the right to remove any erring member or terminate the membership scheme if and when found necessary and in the best interests of the trust.

All the trustees of the trust will be jointly and severally responsible. However, the day-to-day management of the trust may be handled by the chairman or a duly appointed managing trustee, with the help of paid employees.

8) The trustees shall be entitled, from time to time, to open, operate and maintain a banking account or accounts in the name of the said trust, at such scheduled bank or banks as they may, from time to time, decide and may at any time pay, or cause to be paid, or withdraw any moneys forming part of the trust fund or the income thereof to the credit of any such account or accounts and either by way of fixed deposit or current account or any other account. The banking account or acounts may be operated jointly by any two or more authorised trustees of the trust.

9) Any investment or investments in which the trustees may be authorised by law for the investment of the trust property in India, may be made payable or transferable by any two or more of the trustees.

10) It shall be lawful for the trustees to acquire by purchase or on lease or on ownership basis or otherwise, lands, buildings and movable and immovable properties comprised in the trust fund, in any manner they think fit and to expend for all, or any of the above purposes, such moneys out of the trust fund or the income thereof as the trustees may, in their absolute discretion, think fit and proper.

11) With the sanction of the charity commissioner, it shall be lawful for the trustees at such time or times, as they may in their absolute discretion think fit, to sell or acquire by public auction or private contract or exchange or transfer or assign or grant leases or sub-leases for any term, however long, or otherwise dispose of or surrender all or any part of the trust fund including the immovable properties comprised therein and on such terms and conditions relating to title or otherwise and in all respects as they may think proper and to buy and rescind or vary any contract for sale, exchange, transfer, assignment, lease, sub-lease, or other disposition or surrender or release and for such purposes to execute all necessary conveyances, deeds of exchange, assignments, transfers, leases, sub-leases, surrenders, releases, counterparts and other assurances, instruments and writings and to pass, give and execute necessary receipts, releases and discharges for the consideration moneys or otherwise relating to the documents and assurances. All moneys arising from any such transfer or other assurances shall be deemed to be part of the trust fund and shall be applicable accordingly.

12) Upon any sale or other transfer by the trustees, under the power aforesaid, any purchaser or transferee dealing bonafide with the trustees shall not be concerned to see or inquire whether the occasion for executing or exercising such power has arisen or whether the provisions as to the appointment and retirement of trustees herein contained, have been properly and regularly observed and performed. Neither shall the purchaser or transferee be concerned to see to the application of the purchase moneys or other consideration or be answerable for the loss, misapplication or non-application thereof.

13) It shall be lawful for the trustees, from time to time, at their discretion and, if necessary, with the prior permission of the charity commissioner, to borrow or raise or secure the payment of any sum or sums of money and to mortgage or charge all or any part of the trust fund.

14) The receipt of any two trustees, as authorised by the board of trustees, for any income of the trust fund or for any documents of title or securities, papers or other documents or for any other moneys or property forming part of the trust fund, shall be sufficient and shall effectually discharge the person or persons paying or giving or transferring the same from being bound to see to the application or being answerable for the loss, misapplication or non-application thereof.

15) The trustees shall have the power at their discretion, instead of acting personally, to employ and pay any agents (including banks) to transact any business or do any act whatsoever in relation to the said trust, including receipt and payment of money, without being liable for loss and shall be entitled to be allowed and paid all charges incurred thereby.

16) It shall be lawful for the trustees to settle all account and to compromise, compound, abandon, withdraw or refer to arbitration any actions, proceedings or disputes, claims, demands or things relating to any matter in connection with the said trust and to do all other things proper for such purpose, without being responsible for any loss occasioned thereby.

17) The trustees shall be respectively chargeable for such trust funds and income including money, stocks, funds, shares and securities as they shall actually receive, notwithstanding their respectively signing any receipts for the sake of conformity and shall be answerable and accountable only for their own acts, receipts, neglects or defaults and not for those of the other or others of them nor for any banker, broker, auctioner or agent or any other person with whom, or into whose hands, any trust fund or trust income may be deposited or come, nor for the insufficiency or deficiency of any stocks, funds, shares, or securities, nor for any other loss unless the same shall happen through their own wilful default or dishonesty respectively and, in particular, no trustee shall be bound to supervise or to check on any co-trustee or to take any steps or proceedings against a co-trustee for any breach, or alleged breach, of trust, committed by such co-trustee.

18) The trustees may reimburse themselves and pay and discharge out of the trust funds or moneys in their hands, all expenses incurred in or about the execution of the said trust. It is, however, expressly agreed and declared that the trustees shall be entitled to be paid their actual expenses for travel, boarding and lodging, or any other bonafide expense, which may be incurred by them in the performance of their duties as trustees. There shall be no remuneration payable to any trustee.

19) If any trustee, other than the settlor, shall be a lawyer, broker, accountant or person carrying on a profession, he or his firm shall be entitled to charge for his or their services, including all profits, costs and charges and including charges for work not strictly appertaining to a lawyer’s or accountant’s profession, in spite of the fact that he shall be a trustee of these presents, as if he had not been a trustee hereof.

20) The said trust shall be and remain irrevocable for all times, and the settlor doth hereby also release, relinquish, disclaim, surrender and determine all his/her rights, titles, interest or powers in the trust fund.

21) In all matters wherein the trustees have a discretionary power or wherein there shall be a difference of opinion regarding the construction of these presents of the management of the trust fund, or any part thereof, or the execution of any of the trusts or powers of these presents, or as regards any act or thing to be done by the trustees, the votes of the majority of the trustees, for the time being, voting in the matter shall prevail and be binding on the minority as well as on those trustees who may not have voted, and if the trustees shall be equally divided in opinion, the matter shall be decided according to the casting vote of the chairman.

22) Every power, authority or discretion conferred upon the trustees may be exercised or signified, either by some instrument in writing to be signed by a majority of the trustees or such of them as may be present in India, or by a resolution of the majority of the trustees or a majority of such of them as may be in the city and are present and voting at a meeting of the trustees. It shall be necessary to give at least ten days’ notice of any meeting of the trustees, and it shall be necessary to send an agenda and intimate the trustees of what is proposed to be decided at the meeting. Whereas the trustees shall endeavour to meet at least thrice a year and review the progress of the trust, the various sub-committees should meet as often as required, for the effective attainment of the goals and objectives of the trust.

23) If the majority of the trustees for the time being send any notice in writing to any trustee, other than the first trustees above-named, intimating that they think it is desirable in the interest of the trust that the trustee to whom the said notice is sent do cease to be a trustee, then from the date of the receipt of such notice by the said trustee, the said trustee shall be deemed to have resigned from his office as a trustee. Such notice shall be valid irrespective of the fact that there might be any disputes or differences between the trustees to whom the notice is sent, either relating to the affairs of the trust or otherwise. It shall be proper to state in, or with regard to, any such notice the reasons why the trustees giving the notice think it desirable in the interest of the trust, that the trustee to whom the said notice is given, do cease to be a trustee. It is also recommended in the interest of natural justice to give hearing, personal or otherwise, to the trustee to whom any such notice is, or is to be, given. Any such notice as aforesaid shall be deemed to have been received by the trustee to whom it has been sent, if it is duly sent to the said trustee by registered post at his last known place of residence or business.

24) The trustees shall keep, or cause to be kept, all statutory records, including all legal documents, registers, books of account, minute books and have the accounts audited annually by qualified chartered accountants. The financial year of the trust shall begin on 1st April and end on 31st March.

25) It shall be lawful for the trustees, from time to time, to frame such rules and regulations for the management and administration of the trust, as they shall think fit, and to alter or vary the same, from time to time, and to make new rules and regulations, provided that such rules and regulations shall not be inconsistent with the terms and intents of these presents.

26) The trustees may, with the permission of the charity commissioner or any other competent authority in law, make amendments in the trust deed by execution of such deeds or deed-polls, as may be expedient, so as to bring the provisions of the trust in consonance and conformity with the provisions of the law for the time being in force, from time to time, relating to public charitable trusts including compliance with any legitimate directions or requisitions of any authorities or officers which may be deemed expedient for carrying out the objectives of the trust, PROVIDED ALWAYS that no changes shall be made by the trustees which may result in the trust ceasing to be a public charitable trust.

IN WITNESS WHEREOF, the parties hereto have set and subscribed their respective hands and seals, the day and year first hereinabove written.

SIGNED, SEALED AND DELIVERED

by the withinnamed settlors

______________________________

______________________________

______________________________

______________________________

in the presence of

SIGNED, SEALED AND DELIVERED

by the withinnamed trustees

________________________________

________________________________

________________________________

________________________________

in the presence of

2 comments:

Very Comprhensive Private Trust Deed Agreement sample, Thanks a lot for sharing This! Actually i am looking for such an descriptive agreemenet which fulfills all law clauses with effective manner!

Thanks for sharing this post I also share with you some tip hope you like. You can place cash, stock, real estate or other valuable assets in your trust. You meet with an attorney and decide on the beneficiaries and set stipulations. Maybe you say that the beneficiaries receive a monthly payment, can only use the funds for education expenses, expenses due to an injury or disability, or the purchase of a first home. It's your money so you get to decide.

http://www.cmmd.com.au/

Post a Comment