The mission of the social work profession is rooted in a set of core values. These core values, embraced by social workers throughout the profession's history, are the foundation of social work's unique purpose and perspective: *service *social justice *dignity and worth of the person *importance of human relationships *integrity *competence.

Search This Blog

Registration of a NGO under under Foreign Contribution (Regulation) Act, 1976 (FCRA)

Registering an NGO under Companies Act

The institution/associations should apply to Regional Director, Registrar of Companies of the region by a letter along with following documents.

-

Three typewritten copies of draft Memorandum and Articles of Association of the proposed company. No stamp duty is payable.

-

List of names, addresses, description and occupation of the promoters in triplicate.

-

List of companies, associations and other institutions in which promoters are directors or hold responsible positions, with description of positions held.

-

List of members of the proposed board of Directors.

-

Declaration in the prescribed form by an Advocate, Attorney, Pleader, Chartered Accountant or a whole time practising Company Secretary, on a non-judicial stamp paper of appropriate value.

-

Copies of accounts, balance sheet and reports on working of association for last two financial years ( for one year only if the association has functioned for less than two years), in triplicate.

-

Statement of assets and liabilities.

-

Sources of income and estimate of annual income and expenditure.

-

A note on work already done and proposed to be done by the association.

-

Grounds in brief for making application u/s. 25.

-

Declaration signed by each of the applicant.

-

Certified copy of notice published in newspaper .

-

A draft or paid treasury challan for requisite fees for registration.

A copy of the application with all enclosures and accompanying papers should be sent to the Registrar of Companies of the State where the association proposes to situate its Registered Office.

After the draft Memorandum and Articles have been approved by the Regional Director, the association should apply to the Registrar of Companies, for its registration as a company, in Form No.1 along with printed copies of Memorandum and Articles and other documents necessary for registration along with a registration fee of Rs. 500/-. The Registrar then issues a certificate of incorporation.

Special thanks to: Karmayog

Income-tax Act procedure for an NGO

-

Registration of Trust or institution under Income-tax Act procedure for registration u/s. 12AA of I.T. Act.

-

Application for registration in Form No.10A in duplicate.

-

List of Name and Address of the Trustees

-

Copy of Registration Certificate with Charity Commissioner or copy of application to him.

-

Certified True Copy of the Trust Deed.

-

PAN No. or Copy of application of the Trust.

-

PAN of the trustees.

-

-

Procedure for registration (Sec 12AA)

The Commissioner, on receipt of an application for registration of a trust or institution made under clause (a) of section 12A, shall –-

call for such documents or information from the trust or institution as he thinks necessary in order to satisfy himself about the genuineness of activities of the trust or institution and may also make such inquiries as he may deem necessary in this behalf; and

-

after satisfying himself about the objects of the trust or institution and the genuineness of its activities he –

-

shall pass an order in writing registering the trust or institution;

-

shall, if he is not so satisfied, pass an order in writing refusing to register the trust or institution,

and a copy of such order shall be sent to the applicant.

-

Provided that no order under sub-clause (ii) shall be passed unless the applicant has been given a reasonable opportunity of being heard.

-

Charitable or religious trusts, societies and companies claiming exemption under sections 11 and 12 of the Income-tax Act are required to obtain registration under the Act. Private/family trusts are neither allowed such exemption nor required to seek registration under the Income-tax Act. The detailed procedure is as under :

Special thanks to: Karmayog

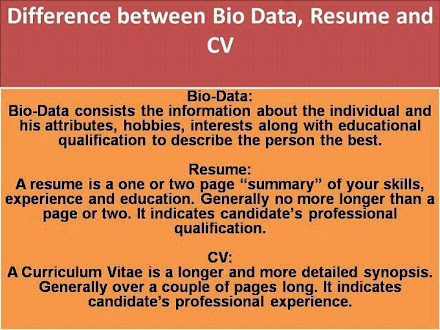

Biodata, Resume and CV

Social Issues Headline Animator

Popular Posts

-

History of Social Work Thanks: Thiru. S. Rengasamy, Lecturer, MISS, Tamil Nadu, India

-

THIS INDENTURE made at (name of City/Town/Village), this (date) day of (month) 19 (year), BETWEEN Mr./Mrs./Ms.______________________________...

-

Tamilnadu Vazhndhu Kaattuvom Project is an empowerment and poverty alleviation project implemented by the Rural Development and Panchayat Ra...

-

If you want something you never had, do something you have never don e........ As the new year blossoms, may the journey of your life be fra...

-

I. Summary A. Types of Organizations 1. Trusts Public...

-

Set up with financial resources contributed by Azim Premji, Chairman, Wipro Corporation, Azim Premji Foundation aims at making a tangible im...

-

Understanding the Narcissistic Phenomenon The so called ‘narcissistic personality disorder’ is a complex and often misunderstood diso...

-

Introduction A public charitable or religious institution can be f...

-

If you were given the task of setting up a new Human Resource Department in a small company where would you begin? Such a task would be extr...

-

Behavior Change Communication (BCC) is a tool for promoting and sustaining risk-reducing behavior change in individuals and communit...

My Headlines

Guidelines to set up a NGO or NPO

- Procedures for registering a NGO under Trust, Society and not-for-profit Companies act

- Starting a NGO or a NPO

- Registeration of a NGO under the Societies Registeration Act

- Formation, registeration and transfering the property of a Trust

- Article of Association format

- Income-tax Act procedure for an NGO

- Registering an NGO under Companies Act

- Registration of a NGO under under Foreign Contribution (Regulation) Act, 1976 (FCRA)

- Fund raising methodology for running a NGO / NPO

- Trust Deed sample

Disclaimer:

Some Indiansocialworker.blogspot.com web pages may provide links to other Internet sites for the convenience of users. Indiansocialworker.blogspot.com is not responsible for the availability or content of these external sites, nor does Indiansocialworker.blogspot.com endorse, warrant, or guarantee the products, services, or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy to which Indiansocialworker.blogspot.com adheres. It is the responsibility of the user to examine the copyright and licensing restrictions of linked pages and to secure all necessary permissions.

- Indian Social Worker Team