-

Introduction

A public charitable or religious institution can be formed either as a Trust or as a Society or as a Company registered u/s 25 of the Companies Act.It generally takes the form of a trust when it is formed primarily by one or more persons.

To form a Society at least seven persons are required. Institutions engaged in promotion of art, culture, commerce etc. are often registered as non-profit companies.

These forms are enumerated as under :

-

Charitable Trust settled by a settlor by a Trust Deed or under a Will.

-

Charitable or religious institution / association can be formed as a society.

-

Charitable institution can be formed by registering as a company u/s. 25 of the Companies Act, 1956, as non profit company (without addition to their name, the word "Limited" or "Private Limited").

-

-

Who can form a Charitable or Religious Trust

As per section 7 of the Indian Trusts Act, a trust can be formed –-

by every person competent to contract, and

-

by or on behalf of a minor, with the permission of a principal civil court of original jurisdiction.

but subject in each case to the law for the time being in force as to the circumstances and extent in and to which the Author of the Trust may dispose of the Trust property.

A person competent to contract is defined in section 11 of the Indian Contract Act as a person who is of the age of majority according to the law to which he is subject and who is of sound mind and is not disqualified from contracting by any law to which he is subject. Thus, generally speaking, any person competent to contract and competent to deal with property can form a trust.

Besides individuals, a body of individuals or an artificial person such as an association of persons, an institution, a limited company, a Hindu undivided family through it's karta, can also form a trust.

It may, however, be noted that the Indian Trusts Act does not apply to public trusts which can be formed by any person under general law. Under the Hindu Law, any Hindu can create a Hindu endowment and under the Muslim law, any Muslim can create a public wakf. Public Trusts are essentially of charitable or religious nature, and can be constituted by any person.

-

-

Capacity to create a Trust

As a general rule, any person, who has power of disposition over a property, has capacity to create a trust of such property. According to section 7 of the Transfer of Property Act, 1882, a person who is competent to contract and entitled to transfer the property or authorized to dispose of transferable property not his own, either wholly or in part and either absolutely or conditionally, has 'power of disposition of property'.Thus, two basic things are required for being capable of forming a trust –

-

power of disposition over property; and

-

competence to contract.

-

-

Who can be a Trustee

Every person capable of holding property can become a trustee. However, where the trust involves the exercise of discretion, he can accept or act as a trustee only if he is competent to contract. No one is bound to accept trusteeship. Any number of persons may be appointed as trustees. However, no trust is defeated for want of a trustee. Where there is no trustee in existence, an official trustee may be appointed by the court and the trust can be administered. An executor of a Will may become a trustee by his dealing with the assets under the provisions of the Will. When an executor is functus officio to any of the assets and yet retains them, he becomes a trustee in respect of those assets.

-

Who can be a Beneficiary

In a private trust the beneficiaries are one or more ascertainable individuals. In a public trust the beneficiaries are a body of uncertain or fluctuating individuals and may consist of a class of the public or the whole public. Generally, a private trust is not a permanent one. But a public trust is of a permanent nature. If properties are dedicated to temples and mosques or gifts are made to religious or charitable institutions they create a trust.

-

Subject matter of Trust

Any property capable of being transferred can be a subject matter of a trust.Section 8 of the Indian Trust Act, however, provides that mere beneficial interest under a subsisting trust cannot be made the subject matter of another trust.

In the case of J.K. Trust vs. CIT (1957) 32 ITR 535 (S.C.), the Supreme Court had held that the word " property" under the Trusts Act is of the widest import and a business undertaking will undoubtedly be a property so that a running business can be made a subject matter of trust. This view has been followed in the case of in CIT vs. P. Krishna Warriar (1964) 53 ITR 176 (SC).

Business may be a taboo for charitable institution from the point of view of exemption for income tax purposes. From time to time, the law has undergone a change as to what business is permitted and under what circumstances. The present law permits only such business which is incidental to attainment of the objects of the trust or the institution, subject to the condition that separate account books are maintained for such business as prescribed under sub-section 4A of section 11 of I.T. Act.

-

Requisites of a Trust

-

The existence of the author/settlor of the trust or someone at whose instance the trust comes into existence.

-

Clear intention of the author/settlor to create a trust.

-

Purpose of the Trust.

-

The Trust property

-

Beneficiaries of the Trust.

-

There must be divesting of the ownership by the author / settlor of the trust in favour of the beneficiary or the trustee.

Unless all these requisites are fulfilled a trust cannot be said to have come into existence.

-

-

Essentials of a valid Charitable or Religious Trust

There are four essential elements of a valid charitable or religious trust –

-

Charitable or Religious Object : The object or purpose of the trust must be a valid religious or charitable purpose according to law ;

-

Capacity to create Trust : The founder or settlor should be capable of creating a trust and dedicating his property to that trust;

-

Certainty of Object and Dedication thereto : The settlor should indicate precisely the object of the trust and the property in respect of which it is made. The property should be dedicated to the trust and the owner must divest himself of the ownership of that property.

-

Concurrence with the law : The trust or its objects must not be opposed to the provisions of any law for the time being in force.

-

-

Instrument of trust – i.e., trust deed

The instrument by which the trust is declared is called instrument of Trust, and is generally known as Trust Deed.It is well settled that no formal document is necessary to create a Trust as held in Radha Soami Satsung vs. CIT- (1992) 193 ITR 321 (SC). But for many practical purposes a written instrument becomes necessary under following cases –

-

When the trust is created by a will irrespective of whether the trust is public or private or it relates to movable or immovable property. This is because as per Indian Succession Act, a will has to be in writing

-

When the trust is created in relation to an immovable property of the value of Rs.100 and upwards, in case of a private trust. In case of public trusts, a written trust deed is not mandatory, even in respect of immovable property, but is optional.

-

Where the trust/association is being formed as a society or company, the instrument of trust; i.e., the memorandum of association, and Rules and Regulations has to be in writing.

A written trust-deed is always desirable, even if not required statutorily, due to following benefits :

-

a written trust deed is a prima facie evidence of existence of a trust ;

-

it facilitates devolution of trust property to the trust;

-

it clearly specifies the trust-objectives which enables one to ascertain whether the trust is charitable or otherwise;

-

it is essential for registration of conveyance of immovable property in name of the Trust;

-

it is essential for obtaining registration under the Income-tax Act and claiming exemption from tax;

-

it helps to control, regulate and manage the working and operations of the trust;

-

it lays down the procedure for appointment and removal of the trustee(s), his/their powers, rights and duties; and

-

it prescribes the course of action to be followed under any eventuality including dissolution of the trust.

-

-

Types of Instrument of Trust

-

Trust deed, where a trust is declared intervivos; i.e., by settling property under Trust.

-

A will, where a trust is declared under a will;

-

A memorandum of association along with rules and regulations, when the association/institution is being formed as a society under the Societies Registration Act, 1860.

-

A memorandum and articles of association where the association /institution is desired to be formed as a Company.

-

-

Trust Deed-Clauses

A person drafting the deed of a public charitable trust has to bear in mind several enactments, particularly the Indian Trusts Act, any local enactment relating to trusts, like the Bombay Public Trusts Act for the State of Maharashtra and the Income tax Act. Such a person has also to keep in mind the relevant judicial pronouncements dealing with the scope of "charitable purpose" and accordingly decide whether a particular purpose is charitable or not. An instrument of Trust

or association/institution created or established should contain inter alia the following clauses:-

Nothing contained in this deed shall be deemed to authorise the trustees to do any act which may in any way be construed as statutory modifications thereof and all activities of the trust shall be carried out with a view to benefit the public at large, without any profit motive and in accordance with the provisions of the Income-tax Act, 1961 or any statutory modification thereof.

-

The trust is hereby expressly declared to be a public charitable trust and all the provisions of this deed are to be construed accordingly.

The Trust Deed, generally contains the following clauses :

-

Preamble

-

Trust name by which Trust shall be known

-

Place were its office shall be situated

-

Author or settlor of the trust

-

Names of the Trustees

-

Beneficiaries

-

The property settled, for Trust – In case of immovable property, it should contain full description of the property sufficient to identify it

-

An express intention to direct the trust property from the trustees

-

The objects of the Trust

-

Minimum and maximum number of Trustees

-

The procedure for appointment, removal, replacement of trustees

-

Trustees rights, duties and powers

-

Administration of trust

-

Provision for maintenance of accounts, auditing etc.

-

Clause enabling, spending and utilization of the Trust funds or corpus.

-

Bank Account operations

-

Borrowing money on security for the purpose of the Trust

-

Investment of the Trust funds and dealing with Trust properties

-

Alienation of immovable property of the Trust

-

Amalgamation clause

-

Dissolution of Trust

-

Irrevocable nature of the trust.

-

-

Registration of Charitable Trust

-

Registration of Public Trust (Sec. 18 of Bombay Public Trust Act)

1. It shall be the duty of the trustee of a public trust to which this Act has been applied to make an application for the registration of the public trust.

2. Such application shall be made to the Deputy or Assistant Charity Commissioner of the region or sub-region within the limits of which the trust has an office for the administration of the trust or the trust property or substantial portion of the trust property is situated, as the case may be.

3. Such application shall be in writing, shall be in such form and accompanied by such fee as may be prescribed.

4. The application shall be made within 3 months of creation of the Public Trust.

5. The application shall inter alia contain the full detail as prescribed in the form of Schedule II – (under Rule-6).

6. Every application made under sub-section (1) shall be signed and verified in the prescribed manner by the trustee or his agent specially authorized by him in this behalf. It shall be accompanied by a copy of an instrument of trust, if such instrument has been executed and is in existence.

6A. Where on receipt of such application, it is noticed that the application is incomplete in respect of any particulars, or does not disclose full particulars of the public trust, the Deputy or Assistant Charity Commissioner may return the application to the trustee, and direct the trustee to complete the application in all respects or disclose therein the full particulars of the trust, and resubmit it within the period specified in such direction; and it shall be the duty of the trustee to comply with the direction.

7. It shall also be the duty of the trustee of the public trust to send memorandum in the prescribed form containing the particulars, including the name and description of the public trust, relating to the immovable property of such public trust, to the Sub-Registrar of the sub-district appointed under the Indian Registration Act, 1908, in which such immoveable property is situated for the purpose of filing in Book No.I under section 89 of that Act.

Such memorandum shall be sent within three months from the date of creation of the public trust and shall be signed and verified in the prescribed manner by the trustee or his agent specially authorized by him in this behalf.

When the Registering Officer is satisfied that the provisions of the Act as applicable to the document presented for registration have been complied with, he shall endorse thereon a certificate containing the word "registered", together with the number and page of the book in which the document has been copied. Such certificate shall be signed, sealed and dated by the Registering Officer, and shall then be the conclusive evidence that the Trust has been duly registered. A registered trust deed shall become operative (retrospectively) from the date of its execution.

-

Procedure for registration

The following documents are required to be filed for registration of a Charitable Trust.-

Covering Letter

-

Application Form in Form –Schedule II under rule 6 duly notarised

-

Court fee stamp of Rs. 2/- to be affixed on application form

-

Certified copy of the Trust Deed

-

Consent letter of Trustees. (Blank Form enclosed)

The office of the Charity Commissioner maintains a register containing all details of the Trust; viz., Reg.No., name and address of the Trust, names of all the Trustees (Past & Present), mode of succession of Trusteeship objects of the Trust, particulars of documents creating a Trust, description of movable and immovable properties, particulars of encumbrances on trust property etc. This register is known as P.T.Register. A certified copy of the P.T. Registrar in Schedule-I (vide Rule 5) can be obtained by applying in simple application with Rs.10/- Court fee stamp by paying prescribed fees for the same. It is advisable for all the trusts to have a certified copy of P.T. Register entry.

-

-

-

Transfer of Movable Property to Trust

A trust in relation to movable property, can be formed also by mere transfer of ownership of the property to the trustee, with a direction that the property be held under trust for the benefit of the beneficiaries. The ownership of a movable property can be transferred by physical act of handing over the possession of the property. The transfer of any symbol of ownership will be deemed sufficient, such as the key of the godown where the property is stored, or the deposit certificate of a Bank wherein the securities are lodged.Where the author himself is the trustee, transfer of possession is neither necessary nor possible; and a mere declaration of the author that he holds the property under trust would be sufficient to constitute a trust.

-

Transfer of Immovable Property to Trust

An immovable property can be transfered to the Trust, either by way of settling the property through a Will or Deed or by way of donating the same to the existing Trust. In all the cases the instrument should be in writing and it should contain complete description of the property so as to clearly identify the property. The title of property should be clear to be transferable to the Trust. It should be free from mortgage and litigation. The instrument by which the immovable property is desired to be introduced to Trust is required to be registered, then only the property can be conveyed in favour of the Trust.An intimation in the form of change report is required to be sent to the Charity Commissioner so as to record an entry in the P.T.Register. The entry in this record is conclusive evidence that the particular immovable property belongs to the Trust. This record contains description and location of the property and the area of the property. This entry in the P.T. Register is necessary for the reason that if in future the said property is desired to be alienated (sold) by the Trust, such an entry is a prerequisite.

The mission of the social work profession is rooted in a set of core values. These core values, embraced by social workers throughout the profession's history, are the foundation of social work's unique purpose and perspective: *service *social justice *dignity and worth of the person *importance of human relationships *integrity *competence.

Search This Blog

Formation, registeration and transfering the property of a Trust

Registeration of a NGO under the Societies Registeration Act

Society as a form of charitable institution will be suitable, where a large number of contributors making regular contributions would require some kind of indirect controls by the office bearers. The best examples are professional organizations.

The Charity Commissioner is also an authority to register such organizations as a society. When a trust is constituted as a society, it is required to be registered under the Societies Registration Act, 1860.

After the Memorandum and Rules and Regulations of the Society have been drafted, signed and witnessed in the prescribed manner, the members should obtain the registration of the society. For the purpose of registration as society, following documents are required to be filed :

-

Letter requesting for registration stating in the body of the letter various documents annexed to it. The letter is to be signed by all the subscribers to the Memorandum or by a person duly authorised by all of them to sign on their behalf.

-

Memorandum of Association, in duplicate, neatly typed and pages serially numbered.

-

Rules and Regulations in duplicate.

-

Where there is a reference to any particular existing places of worship like temple, mosque, church, etc., sufficient documentary proof establishing legal competence and control of applicant society over such places should be filed.

-

An affidavit of the President or Secretary of the society, on a non-judicial stamp paper of prescribed value, stating the relationship between the subscribers, duly attested by an Oath Commissioner, Notary Public or First Class Magistrate.

-

Documentary proof of address such as House Tax receipt, rent receipt in respect of premises shown as Registered Office of the society or no objection certificate from the landlord of the premises.

If the Registrar is satisfied with the documents filed, he then requires the applicant society to deposit the registration fee. Normally, registration fee is Rs. 50, payable in cash or by demand draft. After the registration formalities have been completed and the Registrar is satisfied that the provisions of the Act have been complied with, he issues a certificate of Registration. Certified copies of the Rules and Regulations and Memorandum can be obtained by making simple application.

An entity registered under the Societies Act also gets registration under the local Public Trusts Act; i.e., Bombay Public Trusts Act by making an application simultaneously as mentioned above in case of trust deed. This is so because the definition of a Public Trust in Bombay Public Trusts Act includes a "Society" which is registered under the Societies Registration Act.Special thanks to: Karmayog

Fund raising methodology for running a NGO / NPO

(a) Internal Sources

(i) Membership contribution,

(ii) Sponsorship Fees,

(iii) Sales (such as sales of greeting cards, candles, handicraft items, homemade foods items, books, etc.).

(iv) Interests,

(v) Community Philanthropists (patron members, life members, etc.), and

(vi) Individual Donations.

Besides, an organisation can save resources by using services of volunteers rather than paid staff.

(b) External Sources

Within India:

(a) Grant in aid (from Central or State Government). Various funding schemes operated by different Ministries of the Central Government;

(b) Donations in kind, such as, medicines, books, food items, etc.;

(c) Private institutional or grants from:

(i) Parent NGOs,Outside India (Foreign Sources)

(ii) Corporate Bodies,

(iii) Industrial houses

(iv) Sponsorship for an ticket collections from fund raising events such as charity shows, musical nites, etc.

(v) Advertisements,

(vi) Souveniers,

(vii) Other trusts/organisations,

(viii) Individuals,

(ix) Box Collections

(x) Tourists/Visitors

(a) Bilateral funding;

(b) Multilateral funding;

(c) Private institutional funding;

(d) Overseas non-resident communities.

The purpose for which, and the account of foreign contributions received are regulated by Foreign Contribution Regulation Act, 1976 (FCRA). Further the institutions receiving such funding are required to submit necessary documents and returns.

However, certain foreign donations are exempt from the provisions of FCRA and in respect of them the requirements of documentation and returns are not applicable.

Eligibility Condition

Generally for receiving funding from either Indian or foreign sources, the following are essential conditions:

1. Legal Status: NGO should have a legal status 9i.e. should have been registered as a Society or a Trust or a Company under Sec. 25)

2. Constitution and Working Rules: The NGO should have proper constitution and objectives framed in the form of Memorandum and Articles of Association/ Byelaws/ Trust Deed.

3. Management: It shall have a governing body with authority to conduct the affairs to achieve the main objectives

4. Non profit Character: It should do its activities not for any profit but with an objective to serve the targeted population. Even if it carries on some auxiliary business in the interests of development of its target audience, such profits shall not be distributed by way of dividend to any of its members

5. Involvement: It shall consist of such people who are voluntarily involved in rendering the services to the target society and also shall be able to attract volunteers

6. Not to discriminate: It shall not indulge in discriminating the target group nor use the resources mobilized for furtherance of interests of any political party or involve in creating communal disharmony.

7. Part record: Normally the existing NGO with past record of good service and non discriminating in nature are funded.

Application for Financial Assistance

Application for grant in aid/financial assistance shall be made in the prescribed form or by furnishing, amongst others, the following information/ details:

General Profile for the NGO:

(a) Name, address, legal status (along with details of Registration like Certificate of incorporation/registration no., etc.) and thrust area.

(b) Name(s) and address(es) of Chief/other functionaries of the organisation.

(c) Main activities and sources of funding generally for last three years. Bank details are also required in some cases.

(d) Evaluation of the achievements, if any, carried out by any independent agency along with the report thereof.

Project Profile:

(e) Title of the project.

(f) Aims and objectives along with estimation of targeted beneficiaries, expected qualitative improvement, etc.

(g) Strategy/action plan, details of training required, availability of volunteers and their skills, etc.

(h) Financial requirement, sources of funding and financial assistance required from Govt. under the respective program.

(i) Duration of the project and sustainability after support is completed

(j) Monitoring and evaluation indicators

Documents to be furnished

Generally, the following documents are required to be furnished alongwith the application:

(i) Copy of Registration Certificate

(ii) Memorandum of Association & Bye-laws

(iii) Latest Annual Report

(iv) Audited Accounts along with auditors report/certificate

(v) List of important functionaries and employees

To avail financial assistance under the Central Government Schemes, the organisation/ institution has to follow the general terms and conditions of grants-in-aid as mentioned below:

- The grant receiving agency will be required to confirm in writing that the conditions contained in the grant-in-aid rule are acceptable to it an will execute a bond in favour of the President of India to the effect that in the event of its failure to abide by the same, it will refund the whole or such part of the grant as the Government of India may decide.

- The organisation in receipt of financial assistance shall be open to inspection by an officer of the concerned Department/ Ministry of the Government of India or concerned State Department/ UY administration or a nominee of these authorities.

- The accounts shall be maintained properly and separately and submitted as and when required. They should be open to a check by an officer deputed by the Government of India or the State Government. They shall be open to a test check by the Comptroller and Auditor General of India at his discretion.

- The audited accounts together with the utilization certificate in the prescribed form duly countersigned by the chartered accountants are required to be furnished within six months in respect of a preceding year or after expiry of the duration for which the grant was approved.

- The agency shall maintain a record of all assets acquired wholly or substantially out of the government grant and maintain a register of such assets in the prescribed Performa (if any). Such assets shall not be disposed off, encumbered or utilized for purposes other than those for which the grant was given, without prior sanction of the government of India. If the agency ceases to exist at any time, such properties shall be reverted to the Government of India.

- The programmes of the organisation/institution receiving support under any scheme shall be opened to all the citizens of India without the distinction of being utilized for the approved purpose, the payment of grant may be stopped and the earlier grants be recovered.

- The organisation/ institution must exercise reasonable economy in the working of approved project.

- If the concerned ministry is not satisfied with the progress of the project or it finds that there has been a breach or violation of any of the terms and conditions, it reserves the right to terminate the grant-in-aid.

- The grantee organisation shall implement orders in regard to the reservation of posts for SCs and STs.

- An organisation organizing a seminar/ conference or a workshop under any scheme shall not invite foreign delegates without the prior approval of the Government of India.

- In case of grants for building, the organisation must complete the construction of the building within a period of two years from the date of receipt of the first installment of the grant unless an extension is granted by the Government of India.

- If it is found at a later date that the organisation has withheld or suppressed information regarding grants from other official sources, the grant of the Central Government may be cancelled, reduced or the organisation may be asked to refund the grant already paid to it.

- Equipment purchased out of the grant-in-aid will be the property of the concerned Department/ Ministry, which will decide about its disposal on the completion of the project. The organisation may submit a proposal in this regard before the completion of the project.

- The orgnaisation will submit to the concerned department/ ministry, six monthly progress reports of the project along with a certified statement of expenditure actually incurred and an estimate of expenditure for the next six months period in the prescribed form. The release of subsequent installments will be subject to a satisfactory progress of the project.

- The organisation shall furnish to the concerned Ministry such information as the Ministry may require from time to time.

- All other conditions of the grant shall be as prescribed under General Financial rules, 1963, as amended from time to time.

For the purpose of acceptance of foreign contribution and hospitality, associations have been divided into three categories, viz.:

- Associations registered with the Central Government

- Associations not registered with the Central Government

- Organisations of political nature

An organisation cannot receive project grants from foreign countries through another organisation registered under FCRA, unless the former organisation has obtained either registration or prior permission.

An organisation cannot receive foreign funds on mere filing an application for registration/prior permission, foreign contribution can be received only after the registration/ prior permission is actually obtained.

If the organisation wants to change the designated bank account then a fresh application in appropriate form must be made justifying the reasons necessitating such a change.

Special Thanks to: NPO Online

Starting a NGO or a NPO

NGO/NPOs provide much needed services to their respective communities, and thorough planning during the start-up process is crucial to develop an effective and professional organization that is able to meet the myrid challenges faced by the world today.

There are many classifications of NGO/NPOs as determined by individual country's laws and regulations, including co-ops, credit unions, societies, people's organizations or community groups etc. The classifications can also designate NGO/NPOs as a religious, charitable, educational, scientific, literary or other organizations. These organizations may qualify for income tax exemption, or other financial benefits. Regional and local tax exemptions may also apply on a region by region basis.

This article provides an outline of the general steps needed for starting and incorporating a NGO/NPO. Detailed instructions for each of these steps can typically be obtained from local governments or a designated government agency/board, an attorney, or a local nonprofit management support organization.

The issues covered here are of a very general nature, and actual situations will, of course, vary from country to country. Starting an NGO/NPO may only require a strong vision, or a need, for people to come together as a group and work to satisfy that need. NGOs can range from 1-2 persons working on a single local issue to an international NGO network with thousands of members working globally on a range of issues.

Special Thanks to: Global Development Research Centre

PROCEDURE FOR REGISTRATION OF CO-OPERATIVE SOCIETIES

2. Provisional Committee should be formed and a chief Promoter should be elected from amongst them.

3. Name for the Society has to be selected.

4. An Application has to be made to the Registration Authority for reservation of Name and a letter to that effect has to be obtained confirming the reservation of Name. The name once reserved is valid for 3 Months.

5. The entrance fees and share capital has to be collected from the prospective members.

6. A Bank account has to be opened in the name of the proposed society as per the directions of the registration Authority. The entrance fees and share money has to be deposited in the bank account and the certificate from the bank has to be obtained in that respect.

7. The registration fees has to be deposited with the Reserve Bank of India and receipted 1challan thereof is to be obtained.

8. The application for registration of the society should be submitted to the Registrar of Societies of the concerned municipal ward. The documents to be submitted for registration are as follows :

a. Form No. A in quadruplicate signed by 90% of the promoter members

b.List of promoter members

c.Bank Certificate

d.Detailed explanation of working of the society.

e.4 copies of proposed bye-laws of the society.

f.Proof of payment of registration charges.

g.Other documents like affidavits, indemnity bonds, any documents specified by the Registrar also have to be submitted.

9. The Registrar will enter the particulars in register of application maintained in Form “B” and give serial number and issue receipt in acknowledgment of the same.

10. On registration, the Registrar will notify the registration of the Society in the Official Gazette and issue Registration Certificate.

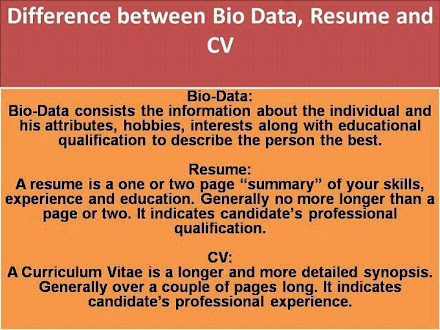

Biodata, Resume and CV

Social Issues Headline Animator

Popular Posts

-

History of Social Work Thanks: Thiru. S. Rengasamy, Lecturer, MISS, Tamil Nadu, India

-

THIS INDENTURE made at (name of City/Town/Village), this (date) day of (month) 19 (year), BETWEEN Mr./Mrs./Ms.______________________________...

-

Tamilnadu Vazhndhu Kaattuvom Project is an empowerment and poverty alleviation project implemented by the Rural Development and Panchayat Ra...

-

If you want something you never had, do something you have never don e........ As the new year blossoms, may the journey of your life be fra...

-

I. Summary A. Types of Organizations 1. Trusts Public...

-

Set up with financial resources contributed by Azim Premji, Chairman, Wipro Corporation, Azim Premji Foundation aims at making a tangible im...

-

Understanding the Narcissistic Phenomenon The so called ‘narcissistic personality disorder’ is a complex and often misunderstood diso...

-

Introduction A public charitable or religious institution can be f...

-

If you were given the task of setting up a new Human Resource Department in a small company where would you begin? Such a task would be extr...

-

Behavior Change Communication (BCC) is a tool for promoting and sustaining risk-reducing behavior change in individuals and communit...

My Headlines

Guidelines to set up a NGO or NPO

- Procedures for registering a NGO under Trust, Society and not-for-profit Companies act

- Starting a NGO or a NPO

- Registeration of a NGO under the Societies Registeration Act

- Formation, registeration and transfering the property of a Trust

- Article of Association format

- Income-tax Act procedure for an NGO

- Registering an NGO under Companies Act

- Registration of a NGO under under Foreign Contribution (Regulation) Act, 1976 (FCRA)

- Fund raising methodology for running a NGO / NPO

- Trust Deed sample

Disclaimer:

Some Indiansocialworker.blogspot.com web pages may provide links to other Internet sites for the convenience of users. Indiansocialworker.blogspot.com is not responsible for the availability or content of these external sites, nor does Indiansocialworker.blogspot.com endorse, warrant, or guarantee the products, services, or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy to which Indiansocialworker.blogspot.com adheres. It is the responsibility of the user to examine the copyright and licensing restrictions of linked pages and to secure all necessary permissions.

- Indian Social Worker Team